Entries Tagged 'business' ↓

October 22nd, 2009 — business, design, economics, software

For a software startup, having a good idea is important, but a good team is essential.

Good ideas are easy to find; I keep a list of interesting business and tech ideas that I constantly update and probably have a couple hundred at the ready.

What’s hard to find, and is much more important for success, is a good team. What are the ingredients of a good team?

Go All In: Look for “Crazy Eyes”

It’s tough to go it alone. While you might succeed nurturing an idea as a side project, your chances of success go up dramatically when you band together with people who complement your skills and are willing to do what it takes to get something to market as quickly as possible.

I call it “crazy eyes.” You need to be able to look somebody else in the eyes and catch that wild-eyed glint of insane dedication – and truly commit to each other as collaborators. If you can’t find people to take risks with, you probably won’t be able to bring your idea to fruition.

Proper Casting

Putting together a good team is all about having the right people in the right roles. First, that means choosing the right people to collaborate with. Second, it means knowing and being honest about the strengths and weaknesses of each individual on your team.

All too often, I have seen people call themselves CEO that really ought to be “Chief Software Architect.” Or people in operational roles who clearly can’t stand being around other people. While it’s tempting to label yourself and your cofounder as COO and CEO, you need to be honest (and educated) about whether you are really right for these positions.

When you go to talk to potential investors, they will sniff out this kind of bad casting right away, and they will just assume you have bad judgment. If they think you have bad judgment about a simple thing like properly casting yourself, then they think you will have bad judgment about everything else; they certainly won’t trust you with investment funds.

Proper casting is a sign of honesty, clarity, and good judgment. It’s key to connecting with investors. Even if you don’t think you need investors, prospective partners and employees pick up on your casting judgment also. Do it right.

A Good Team Always Survives

What may seem like a great idea may turn out to be a bad one, or one that needs to be changed to be successful. Maybe it turns out that kids don’t want to play with horses in your 3D virtual world. Maybe instead, 50 year old men want to play war there. A good team figures that out and capitalizes on it. A bad team spends ever greater sums of money trying to embellish the pretty horses and advertise in kids magazines.

Even in the worst case, a good team that knows its strengths and weaknesses will know how to salvage assets and return value to investors (license the tech to others, etc). A bad team gets mired up in personality conflicts, personal crises, falls apart and becomes toxic to everyone.

This is why investors will almost always bet on a good team with an unproven idea over a sure-fire idea and a so-so team. Good teams deliver returns no matter what.

Good Teams Make Markets

I’ve seen lots of ideas that sound impossible on the surface turned into great businesses through the skills, connections, and experience of their teams. Want to sell WiFi in airports? Sounds impossible, but not if your COO spent 10 years as the director of purchasing for HMS Host. Want to sell an avionics upgrade to the Air Force? Sounds tough, but not if your CEO spent 10 years on contracts at Lockheed.

What a team brings to an idea is more important than the idea. Good ideas are a dime-a-dozen. Finding the people to make a good idea work is incredibly difficult.

Stay Calm and Open to Change

It’s easy for partner relationships to become emotional and strained. Often, partnerships form as a handshake and a promise of 50-50 equity. Operating agreements and buy-sell arrangements often come later, breed resentment, and then become set in stone as people invest increasing amounts of sweat equity.

Don’t let relationships get in the way of execution. While you may be passionate and emotional about your idea, you should be calm and cool about your relationship with your team members. Remember, it’s all about proper casting. Do whatever it takes to put people into the right roles and immediately address any questions regarding equity, hurt feelings, and the like.

There’s no better way to turn a good team bad than to let equity and casting issues fester.

Know a Lot of People

The best way to insure proper casting is to choose the right teammates to begin with. The best way to do that is to know lots of people with diverse skills. This will keep you from going into business with your college roommate and instead partner with people who have the skills that round out your team.

Just Say No

“No” is the most powerful word in business. The pressure to be “moving forward” in our society is intense where to buy propecia. But if team is so important and you also believe in your idea, it doesn’t make sense to move forward with the wrong team or the wrong idea. Just say “no.” Instead, wait it out and find the right team, or at least part of the right team before moving forward. Or change your idea.

Every day I see smart entrepreneurs, under pressure to “move forward,” squandering their time by pursuing an idea with a “halfway there” team. I don’t mean to belittle any entrepreneur’s efforts, and I certainly wouldn’t bet against them. But there’s a difference between doing something just to be doing it (and not really believing in it) and going all-in with people who have what it takes to succeed.

And yes, many entrepreneurs don’t really believe in what they are doing: if they did, they’d quit their day jobs. Building up and then tearing down a half-baked startup takes time as well as real and emotional capital. Why waste all that? Life is short. Find the right teammates (if you need anyone beyond yourself to begin) and then go all in. Your support network will rally around you.

What Investors Look For

You may think investors read your idea first. They don’t. They look at where you live. They look at who your attorney is. They look at your background. They look at your team. Smart investors know that your network says more about you than anything else.

Once they’ve figured out “who you are,” then they consider your idea and determine if you have any hope in hell of delivering what you’re promising. Investors know ideas are cheap; they see them all the time, and usually have many ideas of their own. What they are looking for is why they should bet on you to deliver on your particular idea. And frankly, they are looking to see if you are delusional!

If you are realistic about your chances, have spent time building a good team, and have cast your team members in appropriate roles, most investors will look at any plausible idea favorably. It doesn’t hurt if you share some common acquaintances, either; shared social networks and shared values help ensure long term commitment to the investor and the community. This is why angels almost always invest close to home.

Local Is Best

It’s both tempting and possible to put together a “virtual” company with folks spread around the world. However, investors see this as a sign of team weakness. It means video conferencing instead of face-to-face meetings. It means slower response times. It means travel costs and weaker relationships. In the end, it lowers your chances of success and is just a pain in the ass.

In the context of larger established companies, having some remote workers can make lots of sense. But if you’re trying to launch a startup, do it with the people in your own backyard. Can’t find the right people? Keep digging; see below.

Build Your Network

The single best thing you can do to as an early stage startup is to build up your network of potential team members. And don’t just collect business cards at networking events. Build real relationships. Figure out what makes people tick. Spend time in environments where you take risks with people and try out new things. They will become your casting pool, now and in the future.

One of the best ways to do that is to get involved in your local tech community. Here in Baltimore, we have Beehive Baltimore, which lets freelancers and entrepreneurs spend time working together. From Beehive, TEDxMidAtlantic was born. That event brought over 100 amazing entrepreneurial thinkers together in organizing a 500 person, very complex event. Go to events like Ignite Baltimore; listen to the people around you and think about how you can collaborate with them. Grab lunch and beer with people!

These are just a few observations I have gleaned from my work with Baltimore Angels and with starting and observing many companies over the last 23 years. I welcome your comments!

October 19th, 2009 — business, design, economics, social media, software, trends

I typically hate writing about topical technology subjects, because most often it’s reactive, worthless speculation.

However, the new Twitter “Lists” feature has me thinking; this is an interesting feature not because of the “tech” but because of the implications on the developing economics of social networks.

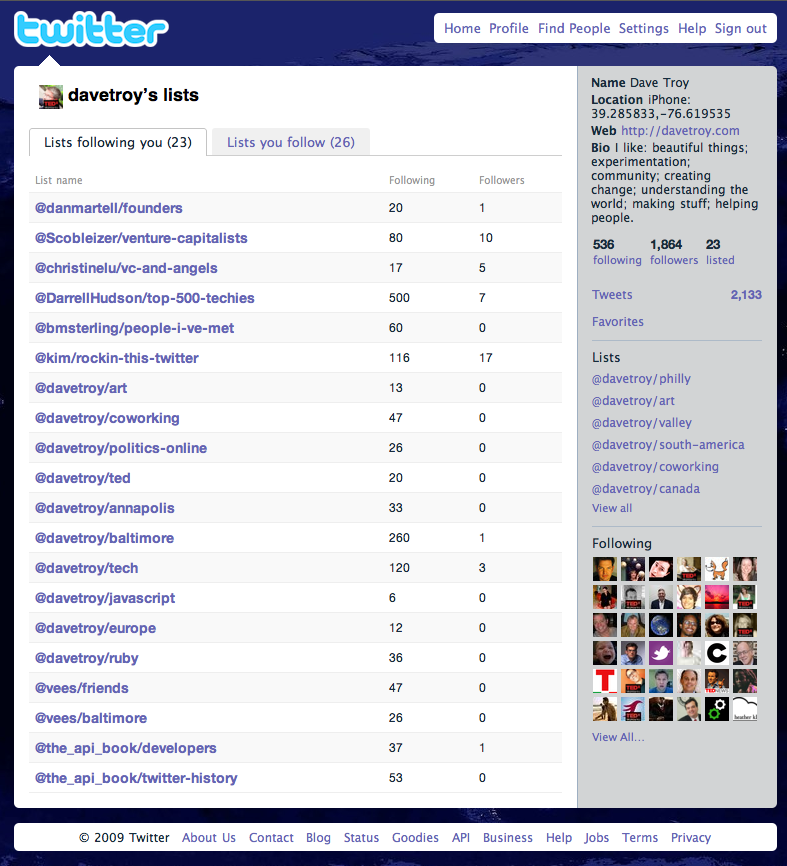

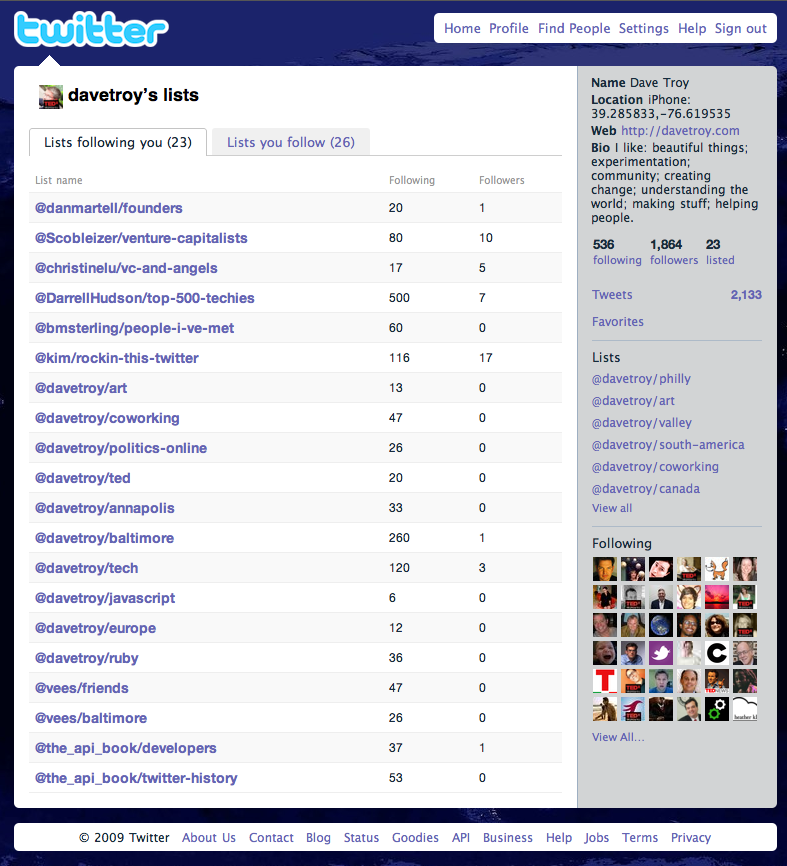

First, what it is: Twitter “Lists” allows you to create lists of Twitter users that are stored within Twitter’s servers. You can name those lists (/twitter.com/davetroy/art) and those URL’s can either be public or private.

People can then follow those lists, which really is more like “bookmarking” them, as they do not appear in your Twitter stream. Those lists in turn keep track of how many “followers” they have, and you can see how many people “follow” the lists you create.

Traditional “Follower Economics” Are Dead

Jack Dorsey and Biz Stone always said that the best way to get real value out of Twitter was to follow a small number of people; it was never their intention for people to aim to follow more than 150-200 people (the “Dunbar number,” or people we can realistically expect to maintain relationships with).

With “Lists” you can add someone to a list, but not necessarily “follow” them. So, instead of “following” Ashton Kutcher, you can put him in a list that you call “actors,” or “attention whores.”

You can even put someone in a list (cool people), have them publicize that, and then change the name of that list to something less flattering (douchebags, or worse).

The issue of derogatory lists alone is one that Twitter will need to address.

So traditional “follower counts” are going to be meaningless – instead of “followers” people are going to start talking about “direct followers,” “indirect followers,” and “being listed.” It’s all changing, and I applaud Twitter for being willing to throw the old (flawed) assumptions about follower economics entirely out the window in favor of a new approach.

Buying Influence and Reputation

Within a few hours of the introduction of “Lists” I was put onto a few:

- @danmartell/founders

- @Scobleizer/venture-capitalists

- @christinelu/vc-and-angels

- @DarrellHudson/top-500-techies

- @kim/rockin-this-twitter

- @the_api_book/twitter_history

This early “seed” of my reputation is quite flattering and arguably pretty powerful (though a fraction of what I expect my ultimate “listings” will be). It shows that I am an “investor” and a “techie,” and considered so by some pretty influential people. I did nothing to influence this and would not consider doing so.

But, I am lucky and glad to have been so-described this early on. What if I really wanted to influence what lists I was on, or to appear on as many lists as possible? I can imagine now the jockeying to get onto the lists of all the “A-List” digitalistas will be intense and powerfully ugly.

Imagine the seedy things that might go on at tradeshows in exchange for getting “listed.”

Going forward, the primary question will be which specific lists you appear on (influence of curator, quality, scarcity) and, secondarily, how many lists you appear on (reach, influence).

“1M Followers” will be replaced by “listed by over 50,000,” or even “listed by the top 10 most influential people in microfinance.” And yes, listing counts will be a fraction of follower count, as lists will necessarily divvy up the people you follow through categorization.

Scarcity: You get 20 lists

It looks like people are allowed just twenty lists right now. That’s undoubtedly a scaling and design decision by Twitter to keep things manageable.

Putting aside for a moment all the reasons why people might want more than 20 lists, let’s accept the limitation. You get 20 lists. So it’s a scarce resource. It means Scoble, Kawasaki, Gladwell, Brogan, Alyssa Milano, Oprah, Biz, etc, all each get just 20 lists.

What will someone pay to get onto one of these lists?

Do you think that an author would pay to get onto twitter.com/oprah/incredible-writers? Yeah, I do too. Now imagine that, writ large, and scummier, with people even less reputable than Oprah. Now you see what I’m talking about.

At least buying followers is a scummy behavior that’s amortized over millions of targets; buying 1/20th of one particular follower’s blessing could lead to very high prices and extremely unsavory dealings.

The Coming “Curatorial Economy”

Twitter is doing this thing, and whatever Twitter does in house trumps anything that a third party developer might do, period. So, stuff like WeFollow, etc, your brother’s cool thing he’s making, Twitter directories: they are done, people. Or these external things must at least accept the reality of Lists and what they mean to the ecosystem.

Some folks have been complaining about the user interface for list management, etc, and that’s all moot: it will be available through the API, and you should expect list cloning, lists of lists, mobile client support, etc, pretty soon.

But the genie is out of the bottle. Start managing your reputation in a way that’s authentic and ethical and stay on top of this. And be prepared for what I’m calling the “curatorial economy.” (You heard it here first.)

Everybody’s making collections, and there are certainly people who will pay and be paid for listings. Count on it.

October 7th, 2009 — baltimore, business, design, economics, trends

You’re smart. You went to the right schools and got good grades, and that’s paid off with a nice job with a decent salary, a healthy upside, and some decent perks. Let’s say you make $125,000 per year.

Now let’s say you quit that job and spend three years founding a technology startup. At first it goes slowly, and things seem desperate. Then you get a break; then you hit it big. At year 5, your startup is worth $3 Million and attracts the attention of a bigger firm. They acquire your company.

So, if you stay in your job, you make $625,000 guaranteed, but you’re turning down a potential shot at a $3 Million exit. So your job is costing you $2,375,000 over the next 5 years. Worth it?

Think I’m wrong? What are you building in equity for the shareholders of the firm where you work? If it wasn’t a good deal for those shareholders, would they want you there?

Think it’s too risky? Sure, a ridiculous number of entrepreneurial enterprises fail, but failure cannot be counted strictly as downside. There is recoverable value in failure.

Too often people cite general statistics about entrepreneurial failure that include all entrepreneurs everywhere and in every sector; these metrics are all but anecdotal in nature. Be realistic in evaluating your chances. Not being stupid helps (we already established you’re smart), and your position in social networks likely has more to do with success or failure than any other factor (read this book).

And please don’t counter that I’ve inaccurately accounted for the capital required to create a startup, how “impossible” it is to get funding, and how doomed you might be for whatever reason before you start: startup capital requirements are lower than ever before – you can get started for as little as $10-$50K with a seed of an idea and the right partner.

Or is it that you’re “too big to fail?” Has your dependence on the lifestyle that The Man has meted out to you eclipsed your willingness to pursue something more valuable? Family, relationships, cars, mortgage payments, kids, restaurants, travel – call them what you will, but these responsibilities often become excuses for inaction.

Getting started young with entrepreneurial activity is a great way to avoid this trap; young people really have nothing to lose, especially teenagers, and it’s easier than ever for a teen to start something today.

While it’s perfectly possible to nurture a side project and wait for it to show signs of life before “quitting your day job,” the real opportunity for success comes in becoming a part of a network of entrepreneurs who are willing to take calculated risks together and that requires a full time commitment. Otherwise, you’re making a calculated decision to expose yourself to a much smaller chance of success. Why?

For every day that you accept payment in exchange for doing your employer’s bidding instead of something you’d rather be doing, you become less likely to take the bold steps necessary to succeed on your own.

What are you waiting for?

September 29th, 2009 — art, baltimore, business, design, economics, geography, social media

This was originally written as a guest post on Gus Sentementes’ BaltTech blog for the Baltimore Sun.

If you had 5 minutes on stage and 20 slides that rotate automatically every 15 seconds, what would you say? That’s the question that 48 presenters will answer at three upcoming Ignite events in Annapolis, D.C., and Baltimore.

Ignite was started in Seattle in 2006 by Brady Forrest and Bre Pettis, and is overseen by the technology book publisher O’Reilly. Since the founding of the program, hundreds of five minute talks have been given across the world.

The first Ignite event in the area, Ignite Baltimore, was organized in October 2008 by local entrepreneurs Mike Subelsky and Patti Chan and was an immediate success. Held at the Windup Space on North Avenue, the event has attracted standing room only crowds, and the upcoming Ignite Baltimore #4 has been moved to The Walters Art Museum in order to accommodate more people. Ignite Baltimore #4 will take place on Oct. 22. Ignite Baltimore was recently named “Best Geek’s Night Out” by Baltimore Magazine.

This week, the first Ignite Annapolis will be held at Loews Annapolis Hotel in their Powerhouse building. Ignite Annapolis is organized by Kris Valerio (Executive Director of Chesapeake Regional Tech Council, and local actress and theater director) and Jennifer Troy (local entrepreneur) and will take place on Thursday, Oct. 1. The event is sold out, but you may be able to get in if you show up early.

And next week, Ignite DC returns with its second event organized by Jared Goralnick (local entrepreneur and organizer) and Steve Lickteig (radio producer). That event will be held at Town Danceboutique, 2009 8th St NW and should feature several hundred people.

While a handful of well-connected area geeks will likely attend all three events, they are inherently local events designed to connect communities together, and really aren’t all that geeky. Topics span everything from art, history, science, philosophy, and of course, some tech and social media. But Ignite is designed to emphasize that tech has become inherently cross-discipline and is no longer the domain of just infotech nerds. So don’t be surprised when topics roam far and wide.

You can get a taste of Ignite by visiting http://ignite.oreilly.com/show/ and viewing some of the videos available there.

Upcoming Area Ignite Events

• October 1, 6:00pm – Ignite Annapolis, http://igniteannapolis.com

• October 8, 6:00pm – Ignite DC, http://ignite-dc.com

• October 22, 6:00pm – Ignite Baltimore, http://ignitebaltimore.com

Note that all three events are already sold out or close to sold out, so if you have not already registered, space will be very limited. However, you may be able to get in if you show up by 5:00. See the RSVP and waitlist policies for each individual event. And if you can’t make these events, get ready for the next round of Ignites, which will be happening early next year. Ignite Baltimore #5 is planned for the first week of March 2010.